By ANDREW ALLEN

There can have been few sadder sights in recent years than the almost nightly displays whereby former Prime Minister Hubert Ingraham gets on local TV apparently determined to lose all of the credibility earned over a successful political and governmental career.

After having essentially stood out the political meltdown of the party that afforded him the opportunity to govern, he nonetheless saw the need to make cryptic, unhelpful comments on the eve of the Free National movement (FNM) convention and even more troubling statements thereafter.

Now the former Prime Minister, despite having no deep understanding of the global financial services industry, gets on television to essentially single out the Bahamian industry for a remarkably ignorant and gloomy prognosis. While he can be forgiven mere ignorance of the global industry, even a child should know that a former (and respected) Prime Minister getting on TV with ill predictions for the local industry can do immense reputational harm to it, especially as he appears to suggest (wrongly) that such doom is in store only for the Bahamas (telling us that our executives can now go work “elsewhere”).

For the information of Mr Ingraham, financial services are merely a small part of the wider, interrelated trade in global services, an area that is growing exponentially and will never be subjected to the kind of “onshore” control that 20th century politicians in Washington or Brussels once wielded.

This has been obvious for at least two decades. It is, in fact, the underlying reason for the “onshore” regimes’ clumsy, panicked reaction. And it is the reason why I and others were disappointed by the launch (under Ingraham’s watch) of the narrowly focused “Bahamas Financial Services Board”, while others had, for instance, the “Barbados International Business Association”.

This suggests a huge gap in the perception of the breadth of the industry between us and our competitors.

“Financial Services” simply cannot be separated from such related fields as Information Technology (IT) and telecoms, into which it naturally elides. And in these fields, the prospects for countries like the Bahamas are better now than those Sir Stafford Sands met in the 1950s. Unfortunately, with mentors like Mr Ingraham, Bahamians will once again probably wake up and smell the coffee when others have already come in and made something of these prospects. Then presumably those who took Ingraham’s advice and took their skills “elsewhere” will move back home looking for jobs. Then there will be complaints about foreigners owning and Bahamians just getting jobs ... the cycle continues.

Mr Ingraham had the ill fortune to be in government at a time when the “onshore” regimes’ focus fell on private banking, an industry around which he and others had unfortunately focused all of our policy energies. They tied our prospects to the success of attracting physical banking institutions from Switzerland, rather than developing educational, planning and immigration policies that would position the indigenous Bahamian business community to take advantage of the features that attracted those institutions here (location, time zone, English language, strong legal and professional infrastructure). Naturally, when the banks were squeezed, the pain was unbearable.

But all that showed was that our focus was too narrow and our growth strategy too tied to the fortunes of banks (traditional, inflexible and easily-targeted institutions, usually headquartered in OECD countries). Another fundamental weakness was that the overwhelming focus of our industry was the management of wealth belonging to “high net worth” individuals in “Developed” countries. This business is not only easily “regulated” (or ”stolen”, depending on your outlook) by onshore governments, but it is notoriously steady and unprofitable when measured against the profits made servicing other demographics.

Today, all the growth in services that has produced billion dollar companies (from Whatsapp to Alibaba to Carlos Slim’s telecom empire) has come from delivering mercantile, telecoms and financial services to poor people in large, poor countries. Bahamian policy makers and businesses need to wake up to the fact that the same comparative advantages that once attracted Swiss banks make us ideally located to thrive in that untapped area, too.

If we define ourselves and our industry into a pigeon-hole, then we will have only ourselves to blame when our gloomy predictions are borne out. But it is a nonsense to suggest that either event is inevitable. The seamless world of ITT has given new, barely limited opportunities in international services and the Bahamas would be foolish to ignore them on account of a stiflingly narrow definition of financial services and a narrow response to the challenges we have recently faced.

It is a tragedy that Mr Ingraham has learned all the wrong lessons from his experiences with the multilateral institutions. It would be a disaster if he managed to pass those mislearned lessons on.

• Comments and responses to insight@tribunemedia.net

Comments

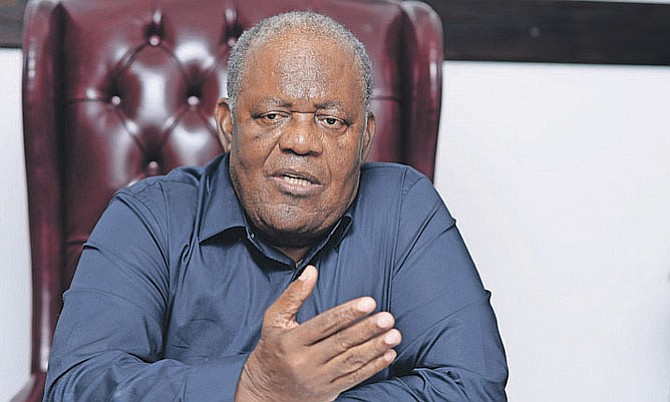

Well_mudda_take_sic 7 years, 8 months ago

Hubiggity's legacy is the obliteration and end of the FNM party. This idiot Ingraham thoroughly enjoys being referred to by voters of Haitian descent as "Papa"; after all, he and Christie have worked together over many years to saddle our fragile Bahamas with an unsupportable enormous population of Haitian related voters and their families. Remember: It was the cruel and barbarian Haitian President Papa Doc who ran Haiti into the ground where it has remained to this very day. Yes, Hubiggity does indeed lend new meaning to the "ugliness" in Bahamian politics today. Just look at him in the photo accompanying this article; he, like Christie, defines the very term "ugliness" in Bahamian politics today! The sooner we send these monsters off to oblivion the better.

Sign in to comment

Or login with:

OpenID