By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

A prominent businessman yesterday sought to reassure that The Bahamas “is nowhere near crisis mode” despite mounting global economic gloom with suggestions that the US is now in an “unofficial recession”.

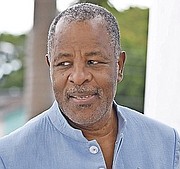

Sir Franklyn Wilson, who is chairman of BISX-listed FOCOL Holdings, the Shell wholesaler, told Tribune Business that an increasingly volatile global economy may be “counterbalanced” by “signs” that elevated global oil prices may ease.

Speaking after it was reported that the US economy shrank in the 2022 second quarter, the second consecutive quarter of contraction and which would meet the definition of a recession, he acknowledged there was “no point in trying to fudge” the potential negative consequences for The Bahamas.

But, while the US is this nation’s major tourism source market and trading partner, Sir Franklyn said The Bahamas was “not in crisis” despite fears that growing global headwinds will disrupt the post-COVID economic recovery and fiscal consolidation efforts designed to eliminate the deficit and rein in an $11.8bn national debt.

“Overall, it’s not good news, no point in trying to fudge that,” he told this newspaper of the latest US economic news. “It’s not good news, but there is some basis for mitigation.” Besides potentially curbing travel and related spending by Americans, Sir Franklyn acknowledged the “psychological” impact yesterday’s developments may have in terms of undermining business and consumer confidence in the short and medium-term outlook.

However, he argued that The Bahamas’ high-end tourism product would likely weather any economic storms better than Caribbean rivals because it was targeted at a wealthier client base. “The Bahamian economy is influenced by people whose income levels are such that they can ride this thing out a little better than the average income earner,” Sir Franklyn said.

“If you have wealth of $1.2bn, and you go to $1.1bn, what difference does it make save and except ego? The point I’m making is that people at the high end of the totem pole are able to ride these things out a little better, and they tend to have a stronger impact on the Bahamian economy than a number of other economies in the Caribbean.”

The US Commerce Department yesterday announced that US GDP declined by an annualised rate of 0.9 percent in the three months to end-June 2022, after contracting by 1.6 percent in the first first quarter. While a recession would have to officially be declared by the US National Bureau of Economic Research (NBER), two consecutive quarters of economic shrinkage meet that definition, leading many to say the US is in an “unofficial recession”.

This capped a week that saw the International Monetary Fund (IMF) warn of increasing global economic headwinds, especially when it comes to food and energy prices, as it slashed its world economic growth forecast for 2022 by 0.4 percentage points to 3.2 percent. And then the US central bank, the Federal Reserve, hiked interest rates by 75 basis points to a range between 2.25 percent and 2.5 percent as it aims to curb inflation running at 40-year highs.

But Sir Franklyn struck a more bullish tone, telling Tribune Business: “We are nowhere near crisis point at this stage, globally or locally. We are nowhere near crisis point......There are signs, let me put it no further, but there are signs that the global oil prices may be headed towards a place where there are downward pressures. It’s not a crisis. It’s [the US contraction] not good news, but it’s not a crisis.”

Oil prices last night stood at $96.58 per barrel, as measured by the West Texas Intermediate index, and $107 per barrel under Brent Crude. Sir Franklyn indicated that current market prices may encourage some oil producers to pump more, and added: “We’re tracking it and will see. God willing if it starts to go this way, we think there will be downward pressure on oil prices.

“In The Bahamas’ case, that could be very significant in counter balancing the impact of a US recession. There are headwinds and tailwinds, and where we are some positive things are happening and some unfortunate things are happening, but overall I think we’re going in the right direction.” He also suggested that price falls for commodities such as lumber indicated some elements of the post-COVID global supply chain crisis are starting to work themselves out.

Hubert Edwards, principal of Next Level Solutions, a Bahamas-based risk management consultancy, told Tribune Business that any US recession is “always going to spell trouble for us” in The Bahamas and Western Hemisphere, but much depends on whether the contraction continues into the 2022 third and fourth quarters - and whether it is to the same extent or lessening.

“If we get to the third quarter and see continuing contraction in a significant way it may eventually have a knock-on effect on The Bahamas,” he added. “It would have implications for tourism and just the robustness of the economy. We are enjoying a decent comeback in terms of our consolidation.”

Comments

tribanon 3 years, 7 months ago

Talk about a bag of hot air. LMAO

Sign in to comment

OpenID