By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

The Bahamas was yesterday urged to use “the reprieve” provided by Europe’s rejection of its own “high risk” countries’ listing to craft “our assault on an illegal process”.

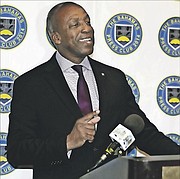

Alfred Sears QC, the former attorney general and Caribbean Financial Action Task Force (CFATF) chairman, told Tribune Business that The Bahamas cannot afford for the European Union (EU) to regroup and come at it again with a new initiative.

While the EU’s 28 national country members had given this nation “breathing space” by vetoing the listing of 23 countries drawn up by the European Commission, its civil service, Mr Sears said The Bahamas needed to use “the window of opportunity” wisely by pressing for all financial crime-related regulatory matters to be placed under the United Nations (UN) oversight.

The Bahamas was included in the list of nations deemed to pose a “high risk” for financial crime due to alleged deficiencies in their anti-money laundering and counter terror financing regimes, with the ex-attorney general describing this as an action that had destabilised its financial services centre at a time when the country was “most vulnerable”.

“It buys us some breathing space,” Mr Sears said of the EU list’s rejection, “but we will either wait for them to regroup and come again or we will defend ourselves so we can put this process in an arena such as an international convention where we have standing to be at the table and help or participate in the process, and ensure through direct involvement an even-handed approach to the rules we help.

“The reprieve only helps the Commonwealth of The Bahamas if we use it to overturn this unequal rolling, moving target and constant destabilisation it has caused - and continues to cause - the Bahamas at a time when we are vulnerable and becoming less competitive.

“It’s a window of opportunity, and I trust the government will use this opportunity well and not see it as a solution but as an opportunity to prepare our defence and also begin our assault on an illegal process under international law and the UN charter,” Mr Sears continued. “The breathing space for us must be a strategic opportunity to defend and challenge.”

International media reports this week revealed that all 28 EU member states will reject the list compiled by the European Commission, which acts as the bloc’s civil service.

Prior to its release there had been strong lobbying by the UK and others against the inclusion of Saudi Arabia, while the US reacted furiously post-publication to the naming of American Samoa, US Virgin Islands, Puerto Rico and Guam.

The EU governments “cannot support the current proposal”, a strongly worded draft statement that will be approved by ministers, is purported to say.

Diplomats complained that the way the EU Commission had drawn up the list was unclear and potentially vulnerable to legal challenges, adding that it “was not established in a transparent and resilient process that actively incentivises affected countries to take decisive action while also respecting their right to be heard”.

Emmanuel Komolafe, a compliance expert, told Tribune Business that The Bahamas should focus on escaping the Financial Action Task Force’s (FATF) monitoring list before the EU issues a revised listing.

The Bahamas’ inclusion on the listing by the FATF, the global standard-setter for financial crime, was cited by all of the EU, UK and US as the rationale for their own advisories warning their financial institutions to apply increased scrutiny to transactions with this nation.

With all The Bahamas’ woes flowing from the FATF listing, Mr Komolafe said: “It’s obvious what we need to do. Ultimately, it’s about getting off the FATF list and making sure we’re off the list.

“We want to be off this one [EU] additional list but, from what I have seen, from an industry perspective it is more concerned about the FATF listing than anything else. The additional scrutiny it attracts for The Bahamas, we’ve seen that more from the FATF listing than the EU listing, and as long as that’s the one industry is concerned with I would encourage the Government to do what it can to get off that list.

“Make sure the FATF understands the changes we’ve made and gives us credit where it’s due rather than keep on listing us.”

Mr Komolafe agreed that EU developments “buy us some time to get off the FATF list” but, while positive news, the bloc’s rejection of its own 23-strong listing was not cause for “over-celebrating” just yet.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment

OpenID