By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

The Central Bank’s governor yesterday warned the tourism industry might not fully recover from COVID-19 until 2023 with the Bahamian economy now projected to contract by 15-20 percent this year.

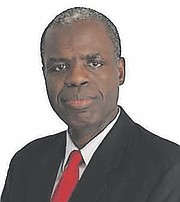

John Rolle, addressing second quarter economic developments, indicated that the regulator had slightly increased its expectations for how much the economy will shrink by this year as he projected that this nation’s proximity to the US will place it at the forefront of any tourism rebound.

“Given the ongoing weight of tourism, the Central Bank now forecasts that the economy could shrink by 15 to 20 percent in 2020, following at least a six-month material pause in activity, with only a gradual recovery to the tourism sector’s normal seasonal pattern,” he said.

“It is projected that a complete recovery in global tourism could be delayed through at least 2023. However, proximity to the US could put The Bahamas on a slightly more accelerated recovery path.”

Mr Rolle conceded that there could be “a further revision” downwards to The Bahamas’ 2020 gross domestic product (GDP) contraction should tourism “prospects for the end of the year look bleak” come October-November, with the latter month containing the Thanksgiving holiday that traditionally signals the start of the winter tourism season.

He added that Bahamian borrowers had “deferred” repayments on around one-third of all outstanding Bahamian commercial banking industry credit, although he did not provide a figure for this. “As conditions are managed going forward, lenders have been encouraged by the Central Bank to limit their forbearance to just borrowers with identified needs, and to begin to adjust loan loss provisioning as they obtain clearer information about when individual borrowers are likely to return to their jobs,” Mr Rolle said.

“Outside of the COVID-19 impact, which is still delayed, the delinquency rate for private credit continued to fall over the first half of 2020 to just below 8 percent of total loans compared to just under 9 percent of such claims in June 2019.

“While the Central Bank expects that this rate will soon start to deteriorate, it does not raise any specific solvency concerns as commercial banks would be able to fully absorb such losses from current levels of excess capital.” That rate will likely further be increased as a result of the two-week national lockdown that began last night.

“The Central Bank has not yet seen the amount of reliance on private sector deposits that were earlier projected,” Mr Rolle said. “Higher spending against such withdrawals would also have been a pressure point on the foreign reserves. It is likely, though that the families most encountering employment hardships are those least likely to have saved meaningful amounts ahead of the economic crisis.”

The Central Bank, in its monthly report for June, said of the tourism sector: “After the borders partially re-opened to private aviation on June 15, the latest data provided by the Nassau Airport Development Company (NAD) showed that total international departures stood at 1,006 during the review month, relative to a seasonal expansion of 16.9 percent to 148,597 in the same period last year.

“During the first half of the year, outward bound traffic contracted by 57.6 percent, a turnaround from a 19.4 percent expansion in the prior year. Underpinning this outcome, the US component reduced by 58.7 percent, a reversal from a 21.1 percent increase in the previous year; and the non-US component decreased by 51 percent vis-à-vis a 10 percent rise in 2019.”

Turning to the vacation rental market, it added: “Data provided by AirDNA for the month of June showed a 67 percent reduction in total room nights sold, as bookings for entire place listings fell by 68.2 percent and hotel comparable listings by 53.6 percent.

“Similarly, the average daily room rate (ADR) for both hotel comparable listings and entire place listings declined by 3.4 percent and 2.2 percent, to $144.47 and $412.68, respectively. On a year-to-date basis, total room nights sold decreased by 39.2 percent, owing to retrenchments of 40.7 percent and 24.8 percent in bookings for entire place listings and hotel comparable listings, respectively.

“Pricing indicators varied, as the ADR for hotel comparable listings moved lower by 1.5 percent to $155.52, while the ADR for entire place listings rose by 1 percent to $405.01.”

Comments

tribanon 5 years, 6 months ago

Minnis will shortly be announcing a total lock down until at least 1st January 2023, at which time he will re-assess the situation and then order a count of how many of us are still alive.

Sign in to comment

OpenID